Investor relations

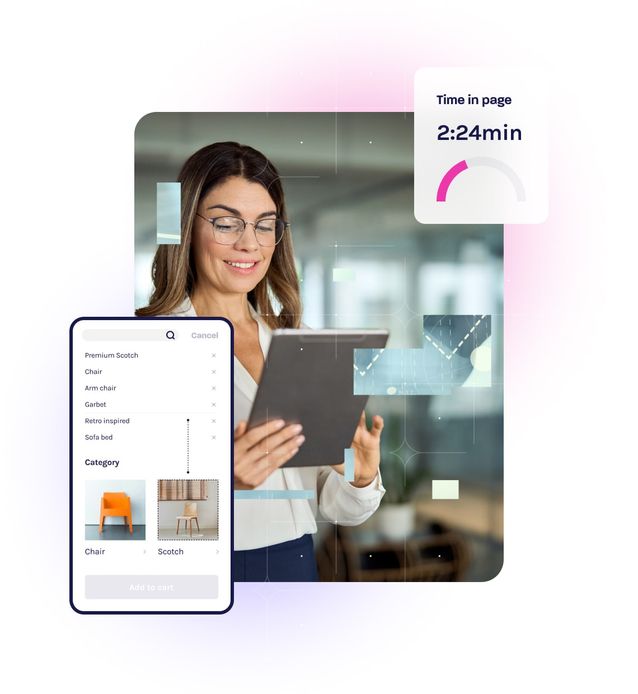

Glassbox (TASE:GLBX) powers the digital business growth of many of the world’s top brands by giving them unprecedented insight into how customers interact with their websites and mobile apps so they can optimize CX and business outcomes.

About Glassbox

Glassbox reveals the insights that empower organizations to deliver better digital customer experiences. Our digital experience intelligence platform automatically captures, visualizes and analyzes every digital journey in real time across websites and mobile apps. It serves as the unifying platform for product, UX, marketing, IT, analytics teams (and more) to assess performance, prioritize projects and optimize experiences.

By the numbers

300+

global customers

$57.3

annual recurring revenue

5x

proven ROI

91%

large enterprise gross retention

>$1M

average contract value for large enterpriseResults and reports

Stock performance

Investor relations

If you have investment questions or inquiries, please contact our Investor Relations team.

Gender pay gap report

View our latest gender pay gap report (Hebrew).

Analyst coverage

Glassbox is aware of the following analyst that produces research reports on the company.

Liran Lublin, Research Analyst - IBI Investment House Brokerage