Insights

Get the latest news, views and tips from digital experience experts at Glassbox.

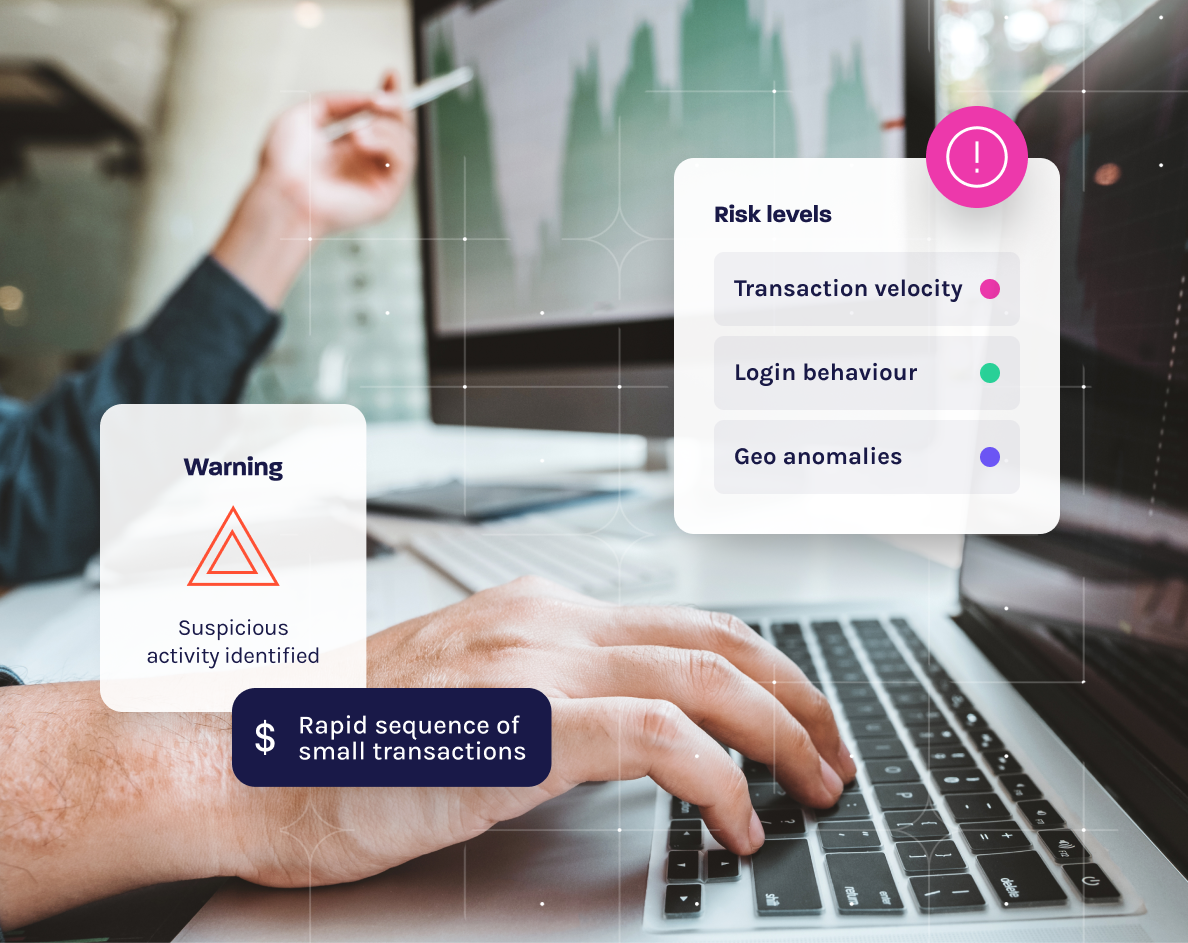

Fraud Prevention Strategies for Financial Services

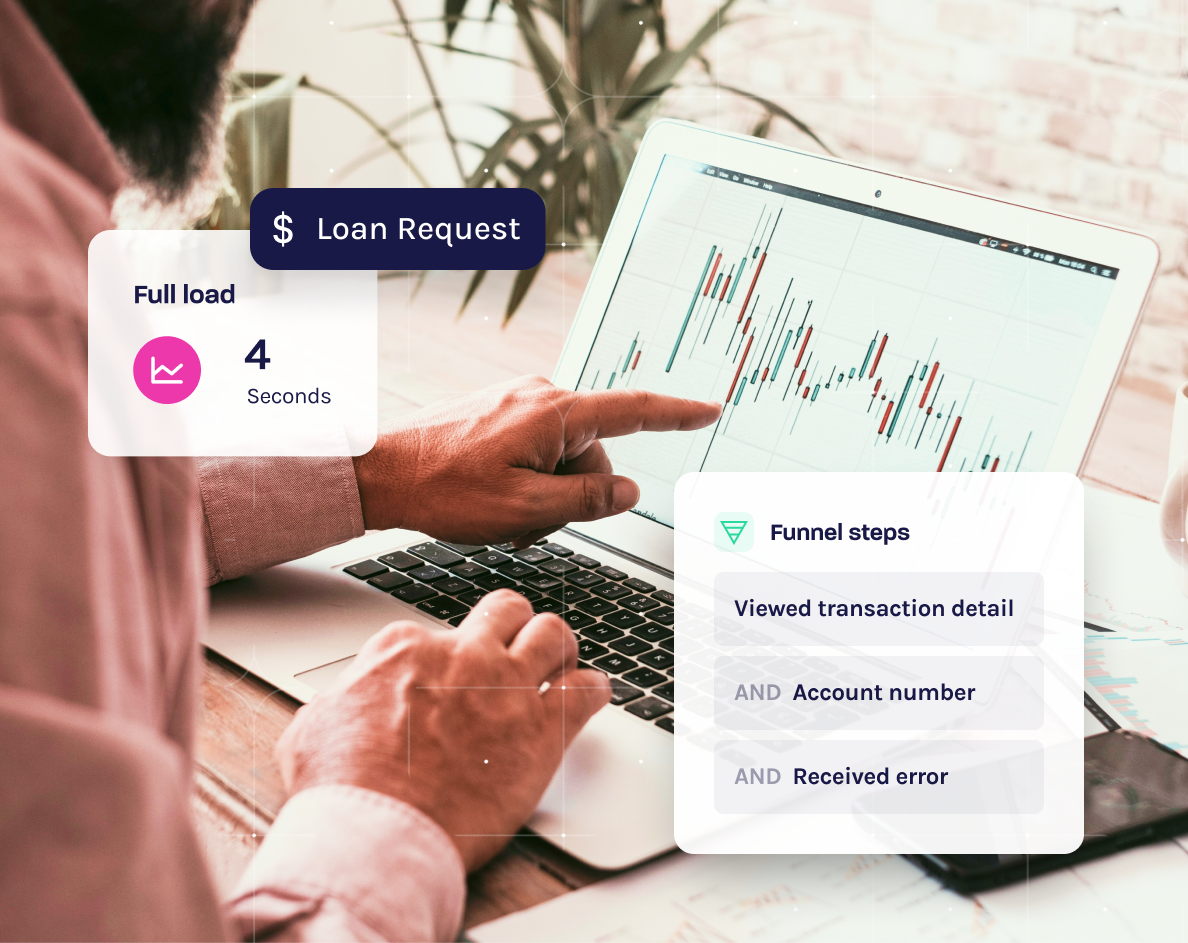

What's Transaction Monitoring and How Does it Work?

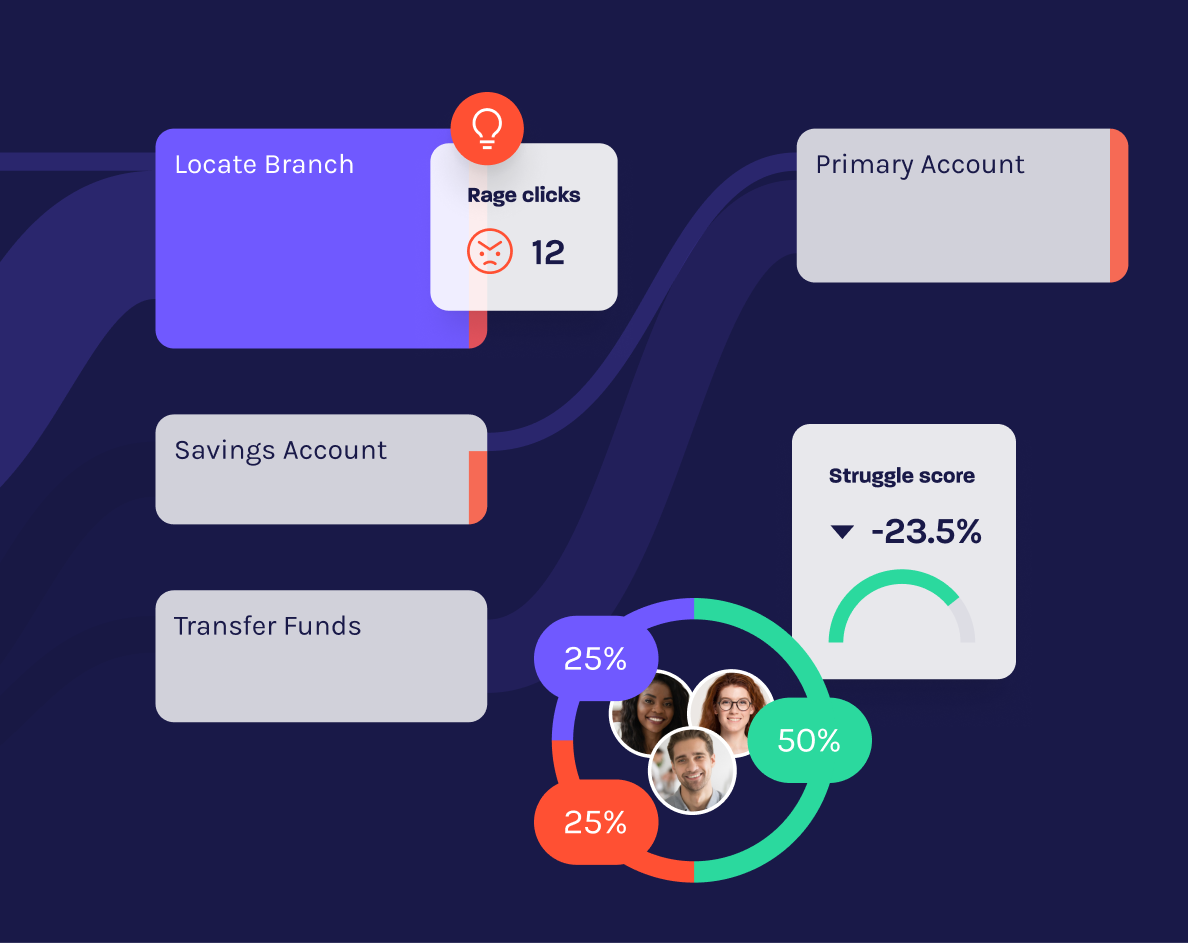

Customer Journey Optimization: Strategies for Every Touchpoint

What Is Fraud Monitoring? How It Works and Why It Matters

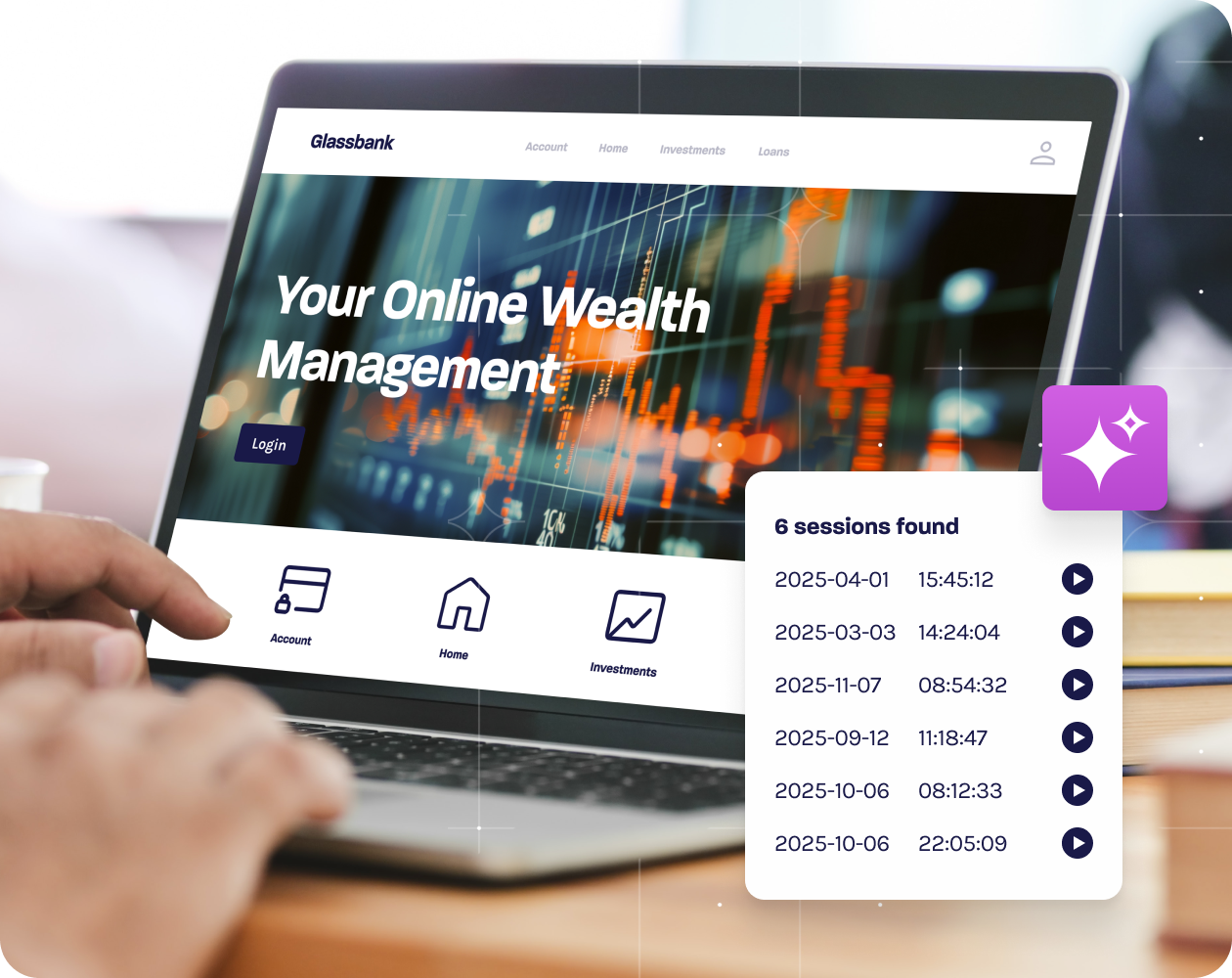

AI in Banking: How AI is Transforming Financial Services

Digital Transformation in Financial Services

Creating Digital Experience With Website Personalization

Enhancing Customer Experience in Financial Services