Effective quote flow optimization in 3 steps [+Best practices to convert more policyholders]

Quote flows are one of the most critical stages of the customer journey—and for many providers, there’s still a lot of room for improvement. Insurance has the highest customer acquisition cost of any industry, yet nearly 75% of customers who attempted to purchase insurance online reported problems.

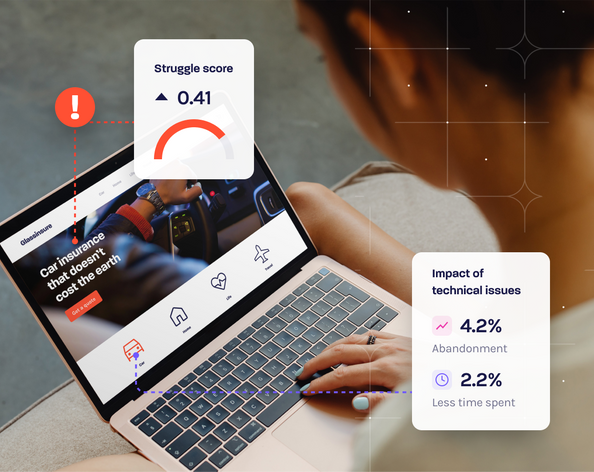

One reason insurers frequently struggle to deliver quality digital experiences is their ability to effectively analyze different stages of the customer journey. We’re talking major data overload. When you can capture every tap, click, and swipe, how do you determine which improvements will actually improve quote flow conversion rates?

The key isn’t just in collecting the right data, but knowing where and how to uncover meaningful insights in your analysis. In this post, we’re taking a look at three steps to boost quote flow conversion rates and best practices to yield actual results.

Let’s get started!

1. Conduct a buyer’s journey audit

Start by mapping out the buyer’s journeys for different user segments. Chart the most common “path” to form submission and form abandonment, including the sequence of actions users performed on different pages or app screens. Good questions to ask:

What percentage of users dropped out of the funnel compared to those who completed the form?

Are there any prevalent characteristics among users who abandoned the form? (i.e. device, browser, geographic location, new visitor vs. returning visitor, etc.)

What page, screen or “step” in the buyer’s journey saw most users drop out? Did they leave before or after they started filling out the form?

Did users who dropped out interact with the same elements on the web page or app screen as converted users?

What were the most prevalent stress behaviors among users who dropped out (i.e. rage clicks, page reloads)? When and where in the journey did they occur?

If the users interacted with the form before dropping off, what was the last question they interacted with? What was the last question they filled out?

What was the last interaction they performed before dropping out of the journey?

2. Identify your most prevalent sources of friction

Examining what the actual journeys looked like for users who completed the quote form submission and those who dropped out will help you zero in on the biggest sources of friction getting in the way. List 3-4 of the most prevalent, including:

Total number of sessions impacted

How many times users encountered this source of friction in a single session before dropping out the funnel

What you believe was the cause for the friction

Pro tip: When looking at field completion times, pay attention to the type of information you’re asking for. A delay field completion could be due to users having to retrieve their driver’s license, rather than lack of clarity. A good clue seeing whether the session is still active during the delay, or becomes idle.

3. Prioritize improvements by business impact

Take your assessment one step further by calculating the amount of revenue that was subsequently lost. Once you’ve integrated customer intelligence analytics with your CRM, you can measure the average amount converted users paid after submitting their quote form.

This will give you a better idea of what abandoned users would have paid if they hadn’t encountered a particular source of friction that caused them to drop out of the funnel. Then, look and see how journeys were impacted to determine scope.

Formula

Average spend of a converted user X Number of abandoned users who encountered a specific

friction in their journey X Typical conversion rate for friction-free journey = Total cost of that friction point

Best practices to improve your quote flow

After you’ve tackled high priority sources of friction, you can refine even further by implementing best practices for a seamless quote flow.

Prioritize information accessibility

Access to information ultimately determines your users’ ability to “self-serve”—and can make or break their entire digital experience.

Satisfaction scores take the biggest hit when customers can’t find information on an insurer’s app or website, and have to call an agent, which happens 42% of the time.

When identifying the biggest challenges with their digital experience, 39% of FSI customers struggled most with poorly integrated or unhelpful chatbots, and 29% with finding necessary information.

To get off on the right foot, make it easy for users to learn about your policies directly from the quote flow—without having to pick up the phone or sift through your site. Our suggestions:

Describe your policies in simple, concise language. Steer clear of jargon, complex terms and legalese—at least in the primary description.

Make policies easy to skim by using headings, short sentences, paragraphs, and summaries or recaps of each section.

Make it easy for users to get help when they need it. For example, if a user exceeds a time threshold for a form field, prompt a chat message offering to connect them with a live agent. This not only improves the digital experience but also increases the odds of users remaining in your quote flow.

Don’t forget the smaller tweaks

Even small tweaks to your quote flow can have a major impact. Case in point: An Post Insurance noticed that 90% of quotes originated from their website, but only 35% were completed. By using Glassbox and validating their observations with call listening, the team identified a single confusing question that led to abandonment. By simply rephrasing the question, An Post boosted its conversion rate by 6%.

Multiple ways to make the quote application process easier for users:

Use auto-complete, auto-suggest and predictive search to help users fill out fields faster.

Integrate typo-tolerance to process fields with spelling errors.

Pre-populate fields with data from prior interactions (i.e. if a user abandons the form and then picks it up again at a later date).

Motivate users with a progress bar visualizing their steps towards completion.

If it suits your brand, include icons or images to spice up the form.

Apply personalization in real time. For instance, after a user submits their name, automatically incorporate it in subsequent questions

Re-engage users who drop out of the quote flow

Don’t forget to create a process for re-engaging prospects who drop out of the quote flow. Nineteen percent of users who previously abandoned an online form will return to complete it if the company initiates additional contact. Instead of a pesky reminder, treat this as an opportunity to provide additional value.

For example, the email could be sent by an agent or customer service rep, asking if the user needs any help or clarification. Also be sure to include a CTA leading users back to the form. Be sure to mention if they can pick up where they’ve left off.

Final thoughts

Improving quote flow conversions isn’t just about optimizing forms—it’s about delivering a seamless and intuitive digital experience that meets user expectations at every stage. Conducting a buyer’s journey audit, examining sources of friction, and letting real user behavior inform your decisions will not only yield more impactful improvements and boost immediate conversion rates, but offer a glimpse of the overall experience policyholders can expect from your brand.