Gen Z's holiday wishlist: smarter banking tools for the digital-first generation

The holidays are here, and for Gen Z, that means a mix of excitement and stress. Gift-giving? Check. Managing budgets? Big check. Staying safe online while shopping? That’s the kicker.

For banks, this season isn’t just about offering festive discounts or cash-back deals. It’s about stepping up to support a generation that juggles financial anxiety with an appetite for digital-first solutions. Our recent survey uncovers where Gen Z struggles most—and how your bank can meet them where they are.

Spoiler alert: “good enough” won’t cut it anymore.

Survey methodology: The “how” behind the “why”

Before we dig into the data, here’s a snapshot of the survey itself. Conducted by Dynata on the behalf of Glassbox in October 2024, the research captured insights from 1,000 U.S. consumers aged 21 and older. From rising Buy-Now-Pay-Later (BNPL) usage to unmet expectations in digital banking and persistent fears around cybersecurity, the findings speak loud and clear: Gen Z demands better.

Now let’s break it all down.

Finding #1: Half of Gen Z plans to rely on BNPL frequently

When you’re living paycheck to paycheck—or stretching holiday funds—the flexibility of Buy-Now-Pay-Later feels like a lifeline. Our survey found that 50% of Gen Z respondents plan to use BNPL frequently this season. It’s fast, it’s easy and for many, it’s necessary.

But here’s the problem: unchecked, BNPL can spiral into financial trouble. Because BNPL can feel like free money—until it’s not. Juggling multiple repayment plans across providers can mean missed deadlines, late fees and a snowball of debt that’s tough to stop once it starts rolling.

What this means for banks

You don’t need to offer BNPL yourself (although that’s worth considering). What you do need is to support your customers in using it wisely. Gen Z doesn’t just want access to payment options—they want tools to help them manage these choices responsibly.

How you can help

Build smarter financial tools: Integrate BNPL-specific features into your app, like reminders for upcoming payments or spending trackers that flag when users might be overextending themselves. This isn’t just about convenience; it’s about trust.

Identify and fix pain points: Tools like session replays let you see exactly where users hit roadblocks in the digital experience. Maybe Gen Z customers are confused by repayment flows or struggling with unclear terms. As Yaron Guetta, our CTO, puts it, “Think of it like the butterfly effect. A specific error or struggle at any point can actually affect the entire experience.” Fixing these moments is key to keeping your audience engaged and confident.

Teach financial literacy, but make it fun: Gamify budgeting lessons. Create social media explainers. Or offer rewards for completing in-app challenges. Education doesn’t have to be boring, and Gen Z appreciates brands that meet them on their level.

For example, Klarna’s “Pay Smarter” feature is a BNPL playbook in action: it tracks payments, offers personalized reminders and helps users avoid financial strain. Banks can borrow this strategy and apply it to a broader suite of financial tools such as automated repayment options and debt snowball calculators.

Finding #2: Nearly a third of Gen Z feels their banks aren’t meeting their expectations

Let’s be honest: Gen Z’s bar for “good service” is sky-high. Ninety percent of customers rate an "immediate" response as essential or very important when they have a customer service question. Meanwhile, 60% of customers define "immediate" as 10 minutes or less. They’ve grown up with one-click ordering and 24/7 customer support. So when 30% of them say their banks don’t meet their expectations, it’s a clear sign you need to do more.

What this means for banks

FinTech startups are eating your lunch, offering features that feel tailor-made for younger users. But you don’t need to start from scratch—enhancing what you already have can go a long way toward winning Gen Z’s loyalty.

How you can help

Go deeper with transaction monitoring: Instead of generic statements, break down transactions into categories like “Holiday Spending” or “Travel Costs.” Gen Z wants to see where their money’s going without having to piece it together themselves.

Introduce virtual credit cards: Online shopping is the go-to for holiday gifting, but it comes with risks. Virtual credit cards, which generate unique numbers for one-time use, offer an easy way to boost security and give your users peace of mind.

Roll out seasonal budgeting tools: Turn holiday spending into a game. Let users set a budget, track their progress in real time and unlock rewards (like extra savings or cash-back offers) for staying on track.

For example, Chime keeps it simple but effective with instant notifications and spending insights across multiple platforms.

Finding #3: Over 50% of consumers are worried about online banking security

The holiday season is prime time for cybercriminals, and over half of respondents in our survey expressed concerns about online banking security during this period. They’re right to worry: data breaches and phishing scams spike in December. The 2022 holiday season alone witnessed an alarming 550% increase in unique threats, highlighting the surge in cybercriminal activity during this period.

What this means for banks

Your security measures need to be rock-solid—but they also need to feel invisible. Clunky, complicated systems won’t fly with a generation that values speed and simplicity.

How you can help

Embrace biometrics: Facial recognition, fingerprint scanning, and voice verification make security seamless and secure, ticking all the boxes for Gen Z.

Send real-time alerts: Imagine a a push notification for every suspicious transaction, paired with one-click options to freeze your card or contact support.

Offer temporary spending limits: Let users set short-term caps on their accounts during the holiday season. It’s a simple way to help them stay on track and avoid overspending.

For example, ahead of the holiday season, the Commonwealth Bank of Australia released a feature for customers to view all digital wallets their payment details have been linked to and remove ones they don’t recognize.

Finding #4: Real-time alerts are how Gen Z stays ahead

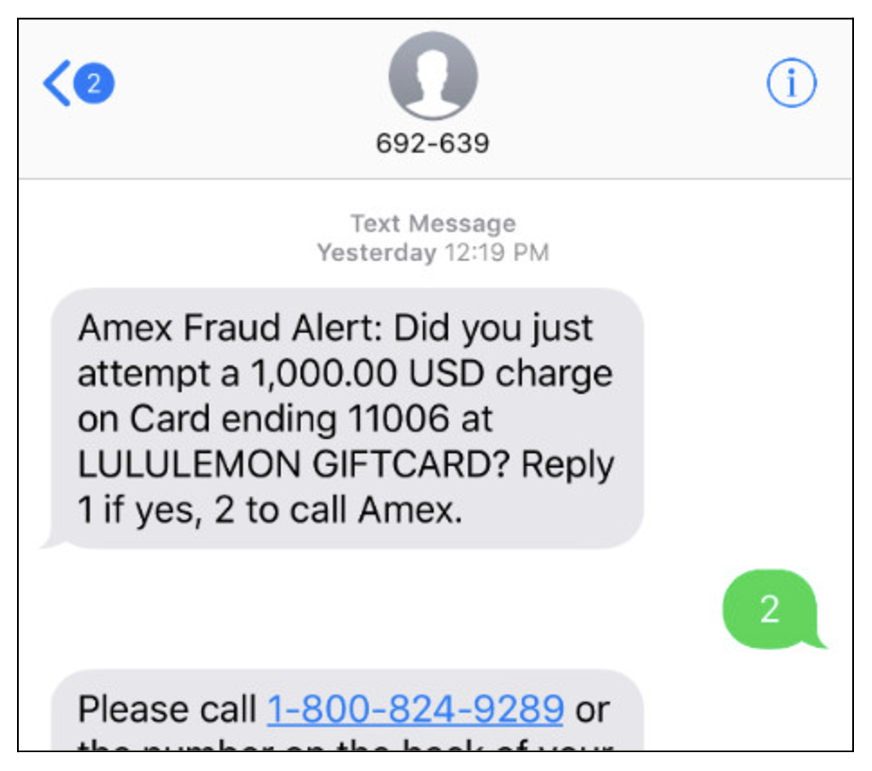

When asked how they want to be alerted about fraud, 20% of Gen Z respondents gave a simple answer: multiple methods simultaneously. Texts, emails, in-app notifications—give them every option. Why? Because relying on just one channel feels like crossing your fingers and hoping for the best.

For Gen Z, fraud prevention can’t be a one-and-done feature. They want it to be proactive, accessible and immediate—especially during the holiday season when suspicious transactions spike.

How you can help

Think redundancy, not efficiency: Gen Z wants to hear from you where they live: on their phones, in their apps and in their inboxes. Offering multi-channel alerts isn’t about overloading them—it’s about building trust that you’ll catch problems, no matter where they are.

Empower instant action: A notification alone won’t cut it. Give users one-tap solutions to freeze cards, dispute charges or connect directly to fraud specialists. The faster they can act, the more confident they’ll feel.

Companies like American Express have nailed this. Their app not only alerts customers about unauthorized charges but also provides simple tools to resolve issues without endless back-and-forth. Banks can follow their lead by combining robust fraud detection with seamless user experiences.

Finding #5: Gen Z craves enhanced transaction monitoring

When asked what features would improve their online banking experience during busy shopping seasons, half (50%) of survey respondents highlighted enhanced transaction monitoring as a top priority. Virtual credit cards for safer online shopping (27%) and holiday-specific budgeting tools (15%) also stood out, with some (12%) requesting temporary spending limits.

Gen Z isn’t asking for bells and whistles—they’re asking for tools that make managing their money simpler, safer and more transparent. Enhanced transaction monitoring is the cornerstone of this demand, helping users stay on top of their spending while flagging anything that looks out of place.

How you can help

Make transaction details crystal clear: No one wants to decode cryptic merchant descriptions. Your transaction monitoring tools should provide instant clarity—think recognizable merchant names, categorized spending insights and visual summaries.

Integrate proactive alerts: Take monitoring a step further with automated alerts for unusual activity. For example, if spending spikes in a specific category, users could receive a nudge: “We’ve noticed higher spending in Apparel—want to review your transactions?”

Expand monitoring to include virtual cards: Virtual credit cards were the second-most requested feature (27%), signaling that Gen Z values both security and ease of use. Integrating these into your transaction monitoring tools ensures users can keep tabs on their spending, even with single-use or rotating card numbers.

Combine monitoring with budgeting: Holiday-specific budgeting tools (15%) and temporary spending limits (12%) were also on the wish list. Pairing these features with enhanced transaction monitoring creates a seamless, all-in-one experience that helps Gen Z stay in control during the busiest shopping season of the year.

Bringing it all together

These findings underscore one thing: Gen Z doesn’t just want better banking, they want smarter banking. From multi-channel fraud alerts to personalized budgeting tools, the opportunities for banks to innovate and engage during the holiday season are immense.

By investing in these features, you’re creating long-term loyalty with a generation that values transparency, speed and empowerment.

Dive deeper into the survey insights and discover how your bank can take the lead this holiday season. Check out the full report here.