Fraud Prevention Strategies for Financial Services

Every day, fraudsters sharpen their tactics, exploiting new technologies and customer touchpoints faster than most security teams can react. For financial services organizations, the stakes couldn’t be higher. One unauthorized transaction can snowball into identity theft, reputational damage and cascading regulatory fines. That’s why proactive fraud prevention has become a board-level priority rather than an afterthought.

Nationwide fraud losses exceeded $10 billion in 2023, and analysts expect that figure to rise as digital channels expand. Relying solely on manual reviews or legacy rule sets is no longer enough. Today, businesses require solutions that learn, adapt and respond in real time.

Glassbox partners with banks, insurers and fintechs to close that gap using digital conduct monitoring and real-time analytics to surface suspicious behavior the moment it happens. Whether it’s a rapid device switch during checkout, unusual form manipulation or an insider attempting to access sensitive information, by capturing every session without tags or blind spots, Glassbox empowers fraud teams to investigate events in context, reduce false positives and act before losses occur.

Discover the most pressing fraud threats facing financial institutions today and how advanced tools and strategies, including those powered by AI, can help you stay one step ahead.

What Is Fraud Prevention and Why Does It Matter?

Fraud prevention is the comprehensive set of controls, policies and tools you deploy to stop unauthorized access, misuse of data and financial crime before money moves or records are compromised. Unlike fraud detection, which reacts after a red flag surfaces, prevention focuses on blocking fraudulent activity at the source. Detection closes loopholes that invite identity theft or an unauthorized transaction. By hardening customer touchpoints, locking down sensitive information and automating anomaly detection, financial institutions shrink the window of opportunity for attackers and curb downstream damage.

The distinction between prevention and detection is more than semantics. Detection waits for a fraud alert and then investigates, whereas prevention uses continuous risk analysis, predictive modeling and layered controls to halt suspicious activity mid-journey. A proactive stance protects revenue, preserves customer trust and aligns with the increasingly stringent compliance expectations of regulators across North America, Europe and Asia-Pacific.

For banks and insurers, ignoring this nuance can be costly. Key fraud risks include:

Payment fraud, where stolen or synthetic credentials fund illegitimate transfers

Identity theft that exploits personal information to open new credit lines

Account takeover attacks hijack login sessions and drain balances

Internal fraud, where privileged insiders manipulate records or override controls

Regulators are responding. Frameworks such as the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA) and Payment Services Directive 2 hold firms accountable for protecting financial information and documenting every decision. Solutions like Glassbox’s digital compliance platform help fulfill that duty by creating a forensic record of every digital journey, masking personally identifiable information at capture and alerting teams to out-of-policy behavior in real time. Understanding why prevention is important lays the foundation for addressing specific fraud tactics.

Common Types of Fraud Financial Services Should Prevent

Knowing the enemy is half the battle. Below you’ll find the most pervasive fraud schemes targeting banks and insurers, the digital fingerprints they leave behind and why a blend of human insight and AI-driven analytics is essential for stopping them.

Account Takeover

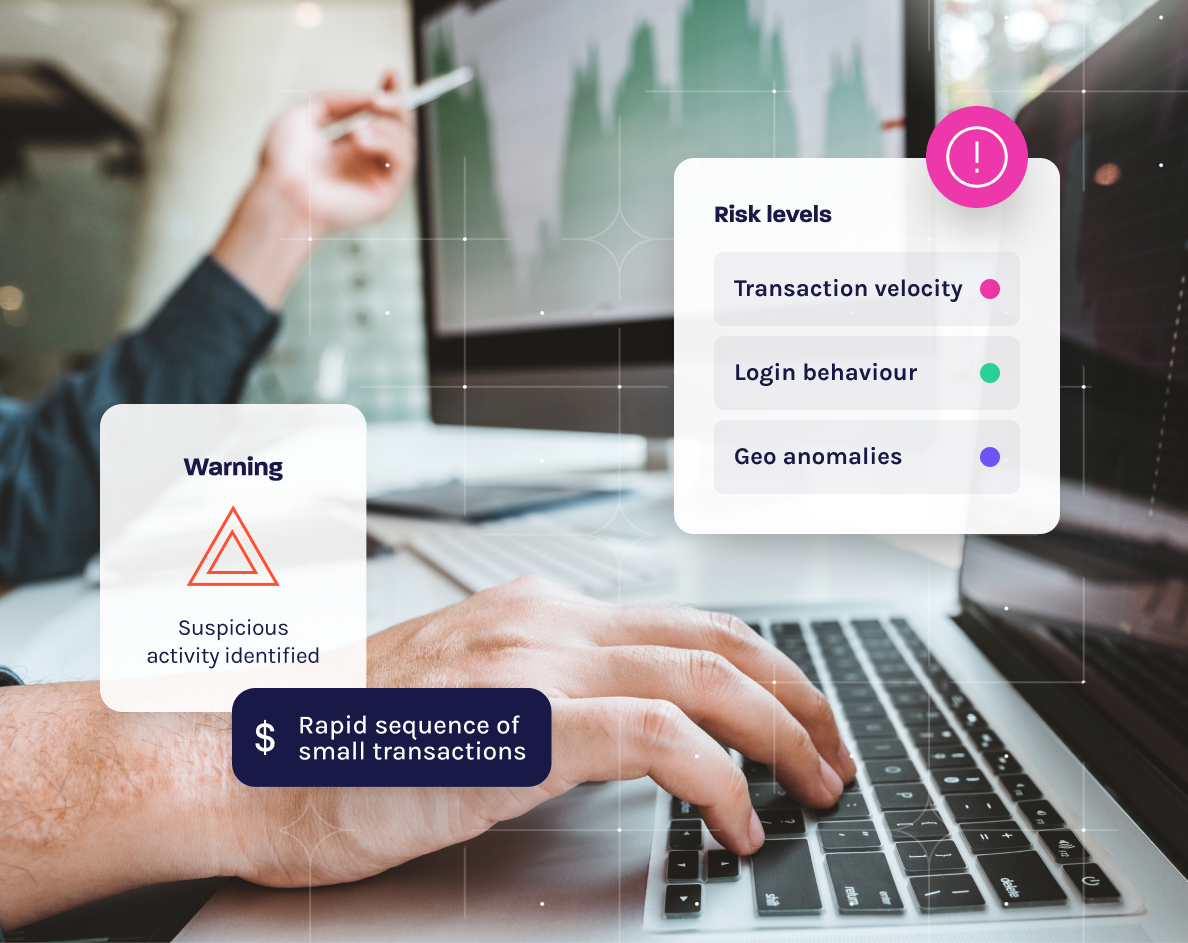

Account takeover occurs when fraudsters gain access to valid credentials, often through phishing schemes or credential stuffing, and then log in as legitimate customers. Telltale signs include repeated failed login attempts followed by sudden success, changes in device or geolocation during a session and rapid updates to profile details such as new payee information. The best prevention strategy involves monitoring session flows for abnormal navigation behavior and triggering step-up authentication when risk scores spike.

Payment Fraud

Payment fraud involves illicit transfers, automated clearing house pulls or wire payments that siphon funds directly from victim accounts. Red flags often include transactions just under approval thresholds, clusters of small transfers in quick succession and IP addresses that don’t align with customer profiles. Real-time transaction monitoring and anomaly detection can be highly effective in flagging these deviations from a customer’s usual spending patterns.

Internal Fraud

Internal fraud is perpetrated by employees who abuse their privileged access to manipulate data, create ghost accounts or authorize unauthorized transaction reversals. Warning signs typically involve after-hours system changes, overrides of dual-approval settings and sudden increases in admin-level activity. The key to prevention is enforcing least-privilege access, maintaining detailed audit trails and deploying digital conduct monitoring to surface unusual administrative behavior and keep customers safe.

Synthetic Identity Fraud

Synthetic identity fraud occurs when fraudsters blend real and fake personal information to create a new identity that can pass Know Your Customer checks. It’s often detected through multiple applications from the same device with slightly varied data, inconsistent credit histories or repeated failed identity verification attempts. Preventing it requires cross-referencing device fingerprints and behavioral signals against identity verification outcomes.

Credit Card Fraud

Credit card fraud occurs when stolen or cloned card details are used to make unauthorized purchases or cash advances. Indicators include transactions in far-flung regions occurring within minutes of each other, unusually large purchases made on new cards and attempts to override card verification value checks. To combat this, organizations can use AI to analyze transaction velocity, device metadata and historical card usage in real time to halt suspicious activity before it escalates.

When you pair deep behavioral analytics with an understanding of these human tactics, you create a multilayered defense that adapts as threats evolve. Now that you know what you’re up against, let’s explore the concrete strategies that elevate fraud prevention from reactive firefighting to proactive risk management.

Key Strategies for Effective Fraud Prevention

To stay ahead of increasingly sophisticated threats, financial institutions must take a proactive, multi-layered approach to fraud prevention, which begins with foundational strategies that strengthen oversight, accountability and response.

Conduct Risk Assessments Regularly

Fraudsters probe every corner of your digital ecosystem, so you need to know exactly where cracks may appear. Start by cataloging every customer-facing flow—account registration, loan applications and payment screens—then rank each for fraud risk. AI-driven analytics and fraud scoring models help you quantify exposure by evaluating device metadata, velocity patterns and historical loss data. With that insight, you can prioritize mitigation efforts based on transaction value, volume and potential impact rather than gut instinct.

Before making changes, map high-risk journeys step by step. Look for pinch points where personal information is entered or credit card details are saved. Tag those points as “critical” in your risk register, assign owners and set review cadences. This disciplined approach keeps fraud prevention aligned with overall risk management while also ensuring resources are utilized where they matter most.

Establish Strong Internal Controls

External threats grab headlines, but insider fraud can be just as devastating. Limiting employee access to sensitive information through role-based permissions curtails the opportunity for misconduct. Pair those controls with comprehensive audit trails that log every administrative change—field edits, privilege escalations and back-end transaction reversals.

Separation of duties is another cornerstone. The person who originates a wire transfer should never be the one who approves it. For especially high-risk actions, enforce dual approval so no single employee can push a fraudulent transaction through unnoticed. These controls may feel burdensome at first, yet they’re proven safeguards that regulators and certified fraud examiners expect to see.

Train Employees To Spot and Stop Fraud

Technology alone can’t outsmart every scam. Continuous training equips staff to recognize phishing emails, social-engineering calls and anomalous payment requests that slip past automated filters. Encourage open communication between compliance, cybersecurity and customer service teams—front-line insights often surface emerging fraud tactics before dashboards catch them.

Bring the training to life with real-world scenarios drawn from recent incidents in banking and insurance. When employees understand how a fraud attempt unfolded and how it could have been prevented, they internalize best practices faster. Complement classroom sessions with monitoring of employee digital behavior; sudden spikes in data exports or off-hours login patterns could signal misuse long before fraud losses occur.

Improve Visibility With Audit Logs

You can’t defend what you can’t see. Comprehensive audit logs record every user action, policy change and transaction reversal, creating a tamper-proof trail for investigators and regulators alike. Consolidate those logs in centralized dashboards that highlight unusual spikes in admin activity or repeated failed access attempts.

Regularly review change logs and privilege escalations to surface hidden risks. Glassbox’s tagless data capture and session replay enhance this visibility by adding behavioral context, showing exactly how a suspicious activity unfolded rather than just when it appeared in the logs.

By weaving strategies together—risk assessments, robust controls, employee vigilance and exhaustive visibility—you can build a resilient fraud prevention framework ready for evolving threats.

How Technology Powers Modern Fraud Prevention

Financial institutions have no shortage of data. The challenge is turning that data into real-time fraud intelligence. Cutting-edge tools transform raw clicks, keystrokes and device signals into early warnings, giving you minutes or even hours of extra response time. Glassbox’s platform integrates these capabilities end-to-end, elevating proactive fraud prevention from theory to daily practice.

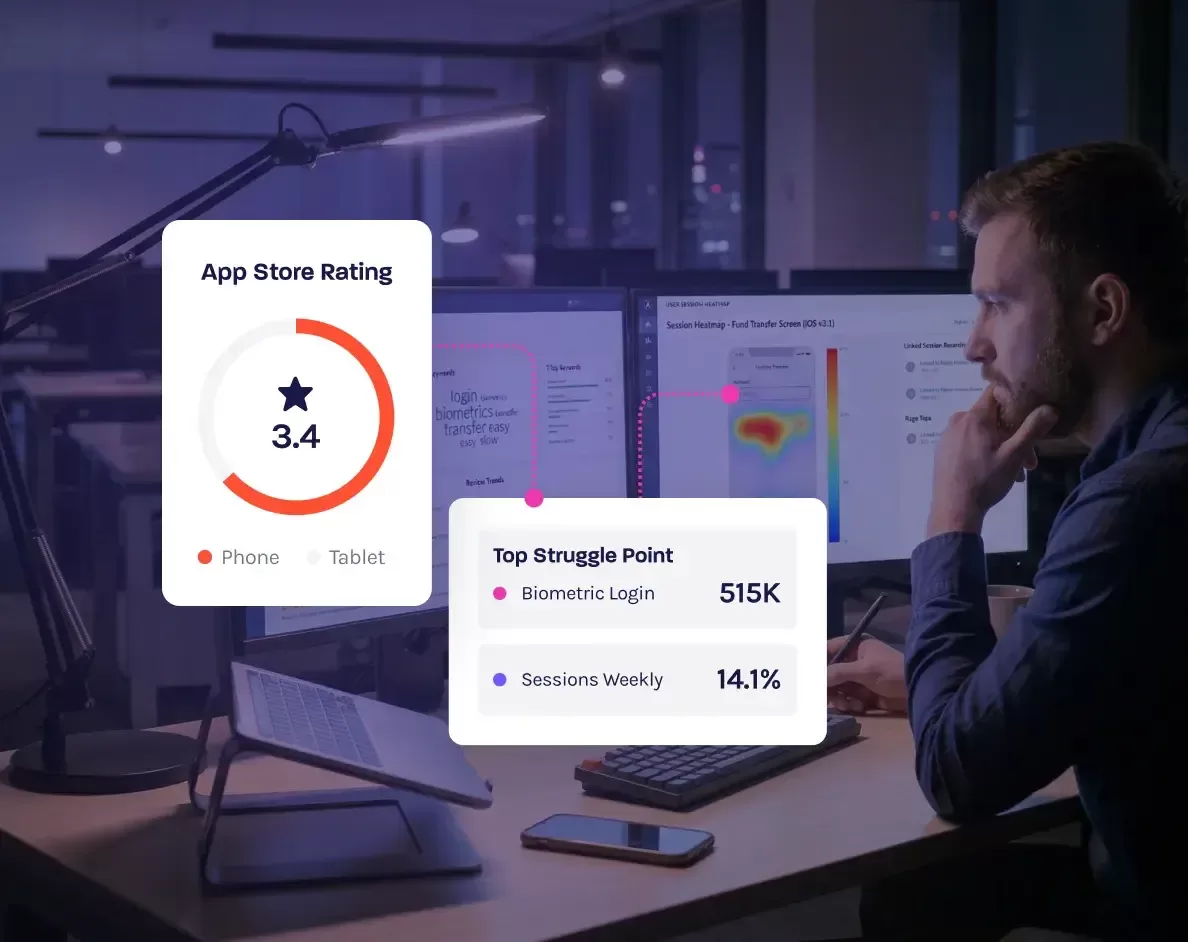

Use Digital Experience Monitoring (DEM)

Digital experience monitoring tracks every interaction across your web and mobile channels, flagging behaviors that deviate from normal customer journeys. By capturing field-level data without manual tags, Glassbox detects subtle fraud risk indicators such as:

Form manipulation where values are pasted instead of typed

Rapid navigation loops suggesting scripted bot traffic

Sudden abandonment at payment confirmation pages after multiple credential checks

Real-time alerts surface these anomalies instantly so fraud analysts can intervene before an unauthorized transaction clears.

Replay Sessions to Investigate Fraud in Context

Logs inform you that a credit card field was updated; session replay shows how, why and by whom. Glassbox records each session pixel by pixel, allowing teams to watch a fraud attempt unfold from the user’s perspective. With this context, you can:

Distinguish a confused customer from a fraudster by methodically testing stolen cards

Validate refund or chargeback claims without second-guessing the customer’s story

Share evidence with law enforcement or certified fraud examiners in a format that’s easy to parse

Investigation cycles shrink from days to minutes, and false positives drop because analysts see the full narrative, not just raw data points.

Map Suspicious Patterns With Journey Analytics

Fraud rarely happens in isolation. Journey analytics stitches together sessions to reveal patterns, such as excessive login attempts, recurring credential stuffing bursts or repeated misuse of promo codes. Comparing these journeys against known fraud cases highlights early indicators such as:

A cluster of devices rotating through hundreds of accounts overnight

Users who consistently abandon transactions once identity verification is required

Segments that trigger multiple fraud alerts, yet never contact support

By visualizing these behaviors, you can reroute at-risk journeys, tighten verification steps and preempt emerging schemes.

Leverage AI and Machine Learning for Real-Time Anomaly Detection

Traditional rule engines struggle to keep pace with evolving fraud tactics. Machine learning excels at spotting outliers no human would catch—mismatched geolocations, lightning-fast device switching or an unexpected surge in failed transactions. Glassbox applies supervised and unsupervised models to millions of micro-signals, instantly flagging sessions that warrant review.

When an anomaly surfaces, the system can automatically:

Escalate the event to fraud teams with a full session replay attached

Trigger step-up authentication or temporarily freeze the transaction

Update risk scores across similar accounts, improving protection network-wide

The result is a dynamic, self-improving fraud prevention strategy that adapts as criminals change tactics.

By uniting DEM, session replay, journey analytics and AI-driven anomaly detection, Glassbox provides a 360-degree shield around every digital interaction.

5 Tips To Prevent Fraud in Your Organization

Even with advanced AI on your side, disciplined operational habits are vital. The following five tips provide quick-win, high-impact measures every financial institution can implement to reinforce proactive fraud prevention.

1. Require Multi-Factor Authentication (MFA)

MFA blocks the majority of credential-based attacks by demanding something the user knows (password) and something the user has (token) or is (biometrics). Enforce it for customer logins and, critically, for all administrator portals. By adding biometric or adaptive authentication, commonly triggered when risk scores spike, you reduce exposure to credential stuffing, brute-force attacks and session hijacking.

2. Limit Access to Personal and Financial Information

Store only the personal information you absolutely need, encrypt it at rest and in transit, and mask it in session replays. Apply least-privilege principles so employees see data relevant to their roles and nothing more. Conduct quarterly access reviews to revoke dormant credentials and close back doors that criminals might exploit.

3. Set Custom Alerts for Suspicious Activity

AI-powered anomaly detection is most effective when tuned to your business context. Configure alerts for red-flag behaviors such as repeated failed logins, unusually fast checkout times or sudden changes to billing addresses. Combine behavioral data with device intelligence—new device fingerprints, proxy usage or mismatched time zones—to sharpen accuracy and minimize false positives.

4. Conduct Regular Audits and Penetration Tests

Fraud tactics evolve, so your defenses should too. Schedule recurring audits of internal logs to uncover unauthorized access or privilege escalations. Complement audits with penetration tests that simulate phishing, account takeover and insider abuse scenarios. Extend these assessments to third-party vendors to ensure their controls meet your risk management standards.

5. Monitor Front-End Interfaces Closely

Web and mobile apps are prime targets for digital fraud. Use session replays to scrutinize user experience friction and uncover exploitation attempts such as hidden form submissions or bot-driven checkout loops. Real-time monitoring detects suspicious behavior—rapid field changes, abnormal navigation paths—allowing you to intervene before fraudulent transactions reach the core banking system.

When you combine these practical steps with AI-driven visibility, fraud prevention shifts from reactive arm-wrestling to strategic risk management.

How Glassbox Supports Fraud Prevention in Financial Services

Glassbox was built for industries where every millisecond counts and every pixel matters. Its tagless data captures 100% of user interactions across web and mobile channels—no manual instrumentation, no blind spots. That complete dataset powers AI models that surface fraud risk indicators as they occur, reducing investigation time and preventing unauthorized transactions before they hit the ledger.

Key capabilities include:

Session replay that lets analysts watch suspected fraudulent behavior in context, differentiating genuine customer friction from deliberate manipulation

Real-time anomaly detection that flags outlier behaviors such as rapid device switching, abnormal navigation paths or multiple failed credential attempts

Digital conduct monitoring that observes privileged user actions, identifying potential internal fraud or policy violations—an essential safeguard against insider threats

Built-in compliance controls that automatically mask personal information, support GDPR and CCPA requirements and create an auditable trail for regulators

The impact is tangible. In one Fintech case study, Glassbox improved fraud detection accuracy by 30% and cut investigation cycles from hours to minutes, enabling the firm to recoup significant losses tied to payment fraud and identity theft. Meanwhile, a global bank adopted Glassbox’s financial services solution to monitor high-risk customer journeys, reducing false positives and enhancing customer experience by minimizing unnecessary security challenges.

By combining exhaustive visibility with adaptive AI, Glassbox turns proactive fraud prevention into a competitive differentiator, protecting revenue, satisfying regulators and strengthening customer trust.

Stop Fraud Before It Starts With Glassbox

Fraudsters adapt fast, but with the right intelligence, you can stay one step ahead. Proactive fraud prevention—powered by complete visibility into every session, touchpoint and anomaly—protects revenue, safeguards customer trust and keeps regulators satisfied. That’s exactly what Glassbox delivers. AI-driven insights, forensic-level session replay and real-time alerts that empower your team to intercept threats the moment they surface.

Ready to transform your defenses? See how Glassbox detects suspicious activity before funds move, reduces false positives and accelerates investigations. Request a personalized demo today, or simply take the platform tour to witness proactive fraud prevention in action.