Smart digital risk management for the online gambling industry

Far and away, online gambling is outpacing its in-person counterparts, with the online industry topping $40 billion in 2016. However, this industry is still being molded. There are questions regarding a number of technical issues when it comes to gambling online, including data security, platform transfers, and troubleshooting.

When it comes to digital risk management, there are numerous steps online gambling companies can take to make sure their website can handle technical issues quickly and efficiently, as well as protect their users’ personal information. With the right tools, gambling sites and apps can cover all their bases through one comprehensive platform.

Multiple platforms

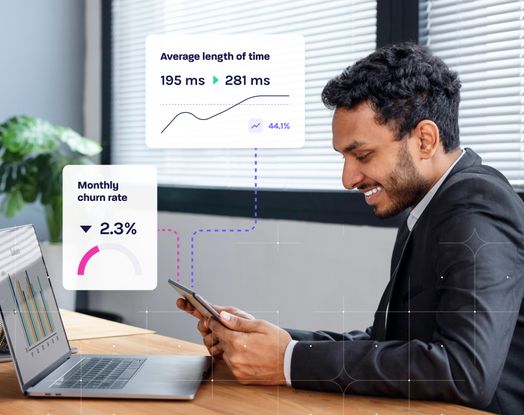

The UK Gambling Commission found in a report that at least 51% of gamblers had gambled on a mobile device or tablet in 2017, up from 43% in 2016. Too many sites are only prepared to handle the maintenance, upkeep, and security of a standard website rather than both a website and a mobile platform. It’s important to develop secure methods for digital risk management in both arenas, and make sure they overlap so accounts are kept intact if a user decides to gamble on more than one device.

When companies fail to consider the mobile element, it can severely weaken their product offering. The online gambling industry is not limited to only a couple of sites, and if there are glitches or data gaps with the mobile platform, players may not feel motivated to jump onto the website as an alternative and instead find a new gaming site altogether.

Data and fraud protection

Digital risk management involves protecting your users’ identity first and foremost. One critical place this is going to come into play is in Europe. Companies doing business in EU countries are going to be enacting new security tools for compliance with the General Data Protection Regulation (GDPR), which is set to go into place on May 25, 2018. This will require companies (including online gambling sites) to change the way they hold and process personal data for their EU users by making sure that the data files are only accessible with a form of decryption key that is kept separate from the files themselves.

The GDPR only extends to the EU and its citizens. However, the growing online gambling industry, especially in countries like the Czech Republic, will see an increase in their need for reliable digital risk management technology to make sure their data is properly stored and compliant with the GDPR.

While the EU has recognized the need for greater data and fraud protection, the rest of the world has yet to follow suit, and many of the online gambling sites still harbor unknown gaps in their security. The GDPR is not only going to change the outlook of needs for managing digital privacy for Europe, but for other international sites as well. Gambling online involves a lot risk; personal data security should not be one of them.

Implementing digital risk management

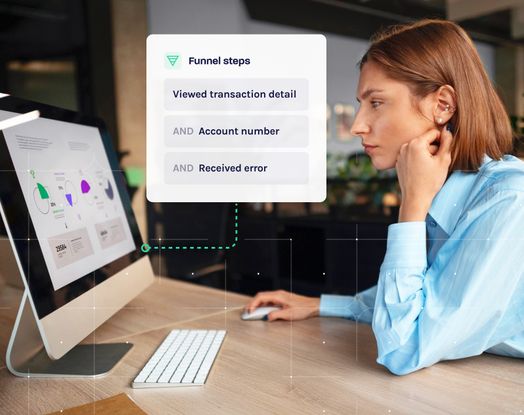

Being able to troubleshoot your users’ issues by actually seeing what they encountered will help your customer service teams as well as your technical support teams to make the changes necessary for a better digital customer experience.

Session replay allows customer service teams, game designers, and fraud prevention officials to see any gaps in security or operations from the same perspective. A unified view means that solutions are streamlined and understood by all members of your staff. For online gambling, legal compliance, secure registration, and an enjoyable playing platform are all critical for success. When these elements come together, your online gambling site can see the success it rightly deserves.