How To Create a Frictionless Customer Experience Digital

Friction rarely appears because someone wants to make a customer’s life harder. It emerges from complexity, organizational silos and blind spots that grow over time—especially in highly regulated industries like banking, insurance and healthcare. Teams build features, add approvals, layer security and introduce new systems without fully seeing how those changes affect the customer journey. In financial institutions and healthcare organizations, these layers are often added to manage risk, compliance and patient or customer safety, but they still impact the experience.

What starts as a small inconvenience becomes a repeating pattern of hesitation, confusion and abandonment—for example, a stalled digital account opening, an incomplete insurance claim or a delayed patient intake form.

Creating a frictionless customer experience (CX) does not happen by accident. It is designed, measured and maintained. You don’t guess where customers struggle—you observe, analyze and remove barriers before they become problems. In banking, insurance and healthcare, this is critical because customers often interact at moments of high urgency, stress or financial sensitivity.

That visibility comes from behavioral analytics and digital experience platforms that reveal what customers do and not just what they say. These tools help teams understand where users hesitate, loop or drop off, and why those behaviors occur. They also connect those behaviors to business outcomes, including conversion, retention and customer satisfaction.

This article explains what a frictionless CX looks like, why it matters more than ever and how teams can systematically remove friction across the customer journey. Along the way, we’ll show how digital analytics companies like Glassbox help organizations gain clarity into customer behavior and uncover friction points that traditional analytics and surveys miss.

What Is a Frictionless Customer Experience?

A frictionless CX minimizes effort across the full customer journey. It removes barriers and reduces complexity so users can move forward without confusion, delay or frustration. It does not mean eliminating every decision or removing all security. In regulated industries such as financial services and healthcare, security and compliance are non-negotiable. It means removing unnecessary friction while still protecting customers, respecting their needs and maintaining trust.

A frictionless experience feels intuitive, responsive and predictable. Customers understand what to do next because the design follows a clear logic. The system responds quickly and reliably. And the journey remains consistent, whether a customer interacts through a website, mobile app or support channel.

Friction shows up in many subtle ways:

Hesitation before clicking a button

Repeated attempts to complete a form

Abandonment in the middle of checkout, during account opening, claims submission or appointment booking

Increased dependency on customer support

Many teams assume friction reveals itself through complaints or low satisfaction scores. But frictionless CX is measurable through behavior, not just sentiment. Customers often don’t describe these moments of friction in feedback because they often feel like their own mistake. Instead, they simply leave.

Behavioral analytics reveal the silent signals: repeated clicks, looping, slow progression and error patterns that show where customers struggle. This insight is critical for identifying breakdowns in high-stakes workflows such as payments, identity verification and sensitive data entry.

Why Frictionless Customer Experience Matters More Than Ever

Customers expect digital experiences to feel effortless. They compare every interaction to the smoothest experiences they have had elsewhere, whether that’s a seamless shopping experience, a fast onboarding process or an intuitive mobile app. When customers face friction, they do not hesitate to switch brands, because they blame the process, not the company.

In financial services, healthcare and insurance, this expectation is even higher. Customers trust these institutions with sensitive data and critical decisions, so friction creates uncertainty and distrust.

Even small points of friction compound into major losses. A single unnecessary step can disrupt a customer’s flow and cause them to abandon a transaction. Friction multiplies when it appears in multiple places across the journey. A confusing homepage, a slow checkout and a complex support process add up to a poor overall experience.

The business impact goes beyond conversion. Friction increases churn, raises support costs and damages loyalty. In financial services and healthcare industries, friction also increases regulatory risk, operational cost and manual intervention.

Customers who struggle once are less likely to return, and they may share negative experiences with others. Meanwhile, teams waste resources repeatedly solving the same issues because they never identify the root cause.

Reducing friction is a revenue and efficiency lever, not just a CX initiative. It improves conversion rates, shortens time to purchase and lowers support volume. For banks, insurers and healthcare organizations, it also improves trust, compliance adherence and long-term customer or patient relationships.

Core Characteristics of a Frictionless Customer Experience

A frictionless experience does not rely on luck. It’s intentional and born of design, data and continuous improvement, even within the constraints of regulation and compliance.

The following characteristics define what a frictionless CX looks like in practice.

User-Centric Design That Reduces Cognitive Load

A frictionless experience begins with a design that reduces cognitive load. Customers do not want to think through complex options or interpret unclear instructions. They want a path that feels obvious and intuitive.

Intuitive layouts, clear hierarchy and predictable interactions reduce effort. When customers can find what they need in a few seconds, they feel confident and in control. When pages show a clear next step, customers move forward without hesitation.

Common failure points include:

Overloaded pages

Unclear next steps

Inconsistent navigation

Many websites and apps try to communicate too much at once. They add features, promotional content and options without considering the user’s intent. This creates cognitive overload and increases friction.

Behavior reveals usability gaps that customers may never articulate. Users may not report a confusing layout, but their behavior—hesitating, scrolling repeatedly or leaving without interacting—shows it. Behavioral analytics provide visibility into these patterns and help teams identify design issues that harm the customer journey.

Streamlined Processes Across the Customer Journey

Streamlined processes reduce steps, decisions and interruptions. A frictionless customer journey removes redundant inputs, eliminates unnecessary authentication and clarifies progress at every stage, while still meeting regulatory and security requirements.

Process friction appears when customers:

Repeat the same information across pages

Encounter unclear progress bars

Have to restart tasks after errors

Receive inconsistent instructions across touchpoints

In practice, process friction is present when a customer abandons a purchase because the checkout requires them to re-enter billing information even though the system already has it, or when a customer stops onboarding because the process lacks clear progress indicators and feels endless.

In banking, insurance and healthcare, process friction can mean failing to complete an application, delaying a claim or abandoning a health enrollment process.

These issues directly cause abandonment and drop-off. Streamlining the journey improves conversions and reduces support volume because customers can complete tasks successfully without requiring additional help.

Personalization That Adapts Without Adding Complexity

Personalization can reduce friction when anticipating customer needs and surfacing relevant options. It becomes friction when it feels intrusive, inaccurate or brittle.

Helpful website personalization adapts to the customer’s context and behavior. It shows the right content at the right time. For example, it reduces effort by:

Pre-filling fields

Recommending relevant products

Adjusting content based on previous interactions

But personalization becomes friction when it relies on assumptions rather than behavioral data. When the system misinterprets customer needs, it creates confusion and frustration. Teams need to base personalization on real customer behavior, not guesses.

Behavioral data reveals what customers actually do, what they avoid, and what they repeat. That data allows teams to create personalized experiences that reduce friction without adding complexity.

Omnichannel Consistency Without Resetting the Journey

Friction increases when customers switch channels and lose context. They repeat actions or explain issues again. They feel like they start over. A frictionless experience maintains continuity across web, mobile and support.

Omnichannel consistency means:

Customers pick up where they left off

Customer data flows across channels

Support teams see the full journey context

Interactions remain predictable across devices

This continuity requires journey visibility. Teams must see how customers move between channels and where they encounter friction. Without this visibility, organizations treat each channel as a separate problem instead of a single customer journey.

Proactive and Smooth Customer Support

Frictionless support focuses on prevention first, not just fast resolution. Many support interactions exist because customers encounter friction earlier in the journey. When teams proactively fix those issues, they reduce support volume and improve satisfaction.

A frictionless support experience includes easy self-service options, clear guidance and rapid resolution when customers need help. It also relies on behavioral analytics and voice of the customer insights to identify issues before customers contact support.

When teams can detect patterns of friction, they can address root causes. They can also use behavioral data to prioritize improvements based on real customer impact.

Frictionless Payments and Conversions

Checkout and payment flows are high-risk friction zones, particularly in banking, insurance premium payments and healthcare billing. They require trust, speed and clarity. When payment flows break, customers abandon transactions immediately.

Common friction signals include:

Rage clicks on payment buttons

Repeated form retries

Failed submissions without clear error messages

Unexpected authentication steps

These signals directly impact revenue. A frictionless payment experience reduces friction by simplifying forms, removing unnecessary steps and providing clear feedback. It also builds trust, because customers feel confident that the transaction will be completed successfully.

How To Identify Friction in the Customer Journey

Friction often appears unintentionally and becomes systemic over time. Teams add features, create new workflows and integrate new tools without seeing how the customer journey changes. Over time, friction accumulates.

Common causes of friction include:

Siloed teams and disconnected data

Assumption-based design decisions

Overreliance on surveys and lagging indicators

A focus on what customers are saying rather than what they are doing

Traditional metrics and surveys miss critical friction because customers rarely report friction. They may feel frustrated, but they don’t often share detailed feedback. This creates “silent friction”—friction that never appears in customer feedback.

CX metrics can help teams quantify friction, but they still only capture part of the story. Metrics like customer satisfaction, task completion rates and net promoter score reveal outcomes, but they don’t always show why customers struggle. That’s why teams need both outcome metrics and behavioral signals.

Behavioral signals reveal friction at scale across regulated, multi-step digital journeys that traditional analytics struggle to capture. Teams can identify hesitation, looping, errors and abandonment across the customer journey. These signals reveal where customers struggle, how often friction occurs and what impact it has on conversion and satisfaction.

To remove friction effectively, teams need to identify friction systematically—not through anecdotes, but through data. Behavioral analytics reveal patterns that teams can prioritize and fix with confidence.

How To Create a Frictionless Customer Experience

Creating a frictionless CX requires a clear, step-based approach. Teams must observe behavior, identify friction, prioritize fixes and continuously validate improvements while maintaining compliance, security and operational resilience. The process also requires cross-functional alignment between CX, product and engineering teams.

Step 1: Observe Real Customer Behavior Across Journeys

The first step is to observe what customers actually do. Behavioral analytics provide visibility into every interaction, including clicks, scrolls, navigation paths and errors. This data shows where customers hesitate, loop, or abandon.

Teams can map journeys from initial discovery to purchase, onboarding, and ongoing usage. The goal is to see the full experience, not isolated touchpoints. To understand how to map journeys effectively, teams can use CX journey mapping.

Step 2: Identify Friction Points and Their Business Impact

Once teams see behavior, they identify friction points and connect them to business impact. Not all friction carries equal weight. Some friction causes minor annoyance, while other friction causes major abandonment.

Teams should look for friction that causes the most damage, such as:

High drop-off during checkout

Repeated support tickets for the same issue

Slow onboarding completion

Frequent errors or retries during critical tasks

In financial services, this might include abandoned loan applications, incomplete claims or patients dropping out of online care enrollment.

Step 3: Prioritize Fixes Based on Conversion, Effort and Frequency

Teams should prioritize fixes using a simple framework: impact, effort and frequency. Fixes that affect high-value journeys and occur frequently should receive priority. This ensures teams focus on the highest return improvements.

Prioritization also prevents teams from spending resources on low-impact changes. It keeps the organization aligned on what matters most.

Step 4: Resolve Root Causes, Not Surface Symptoms

Many teams fix symptoms without addressing the root cause. For example, they may add a tooltip to explain a confusing form instead of redesigning the form itself. This approach may reduce complaints temporarily, but fails to remove friction permanently.

Teams must address the underlying issue. Behavioral analytics help identify root causes by showing where and how customers struggle and enabling the team to redesign experiences that remove the identified friction at its source.

Step 5: Continuously Validate Improvements With Live Data

Frictionless CX is not a one-time project. Customer behavior evolves, new features introduce new friction and external factors change expectations. Teams must continuously validate improvements using live data.

Behavioral analytics provide real-time visibility into how changes affect the customer journey. Teams can measure conversion, customer satisfaction and support volume to confirm that friction decreases and results improve. This approach supports ongoing customer journey optimization.

The Role of Cross-Functional Alignment Across Teams

A frictionless experience requires alignment across CX, product, engineering and marketing. Each team influences different parts of the journey, and friction often appears at the intersections between systems. Collaboration is key to consistently removing friction.

For example, marketers may drive traffic through marketing emails and campaigns, but product teams must ensure the landing page delivers a seamless experience. Support teams must also understand common friction points to provide faster resolution and feedback.

Glassbox: Turning Frictionless CX Into a Competitive Advantage

A frictionless CX drives conversion, loyalty and efficiency even in the most complex, regulated industries. It improves customer satisfaction, reduces support costs and strengthens customer relationships. It also differentiates brands in crowded markets, because customers choose experiences that feel effortless.

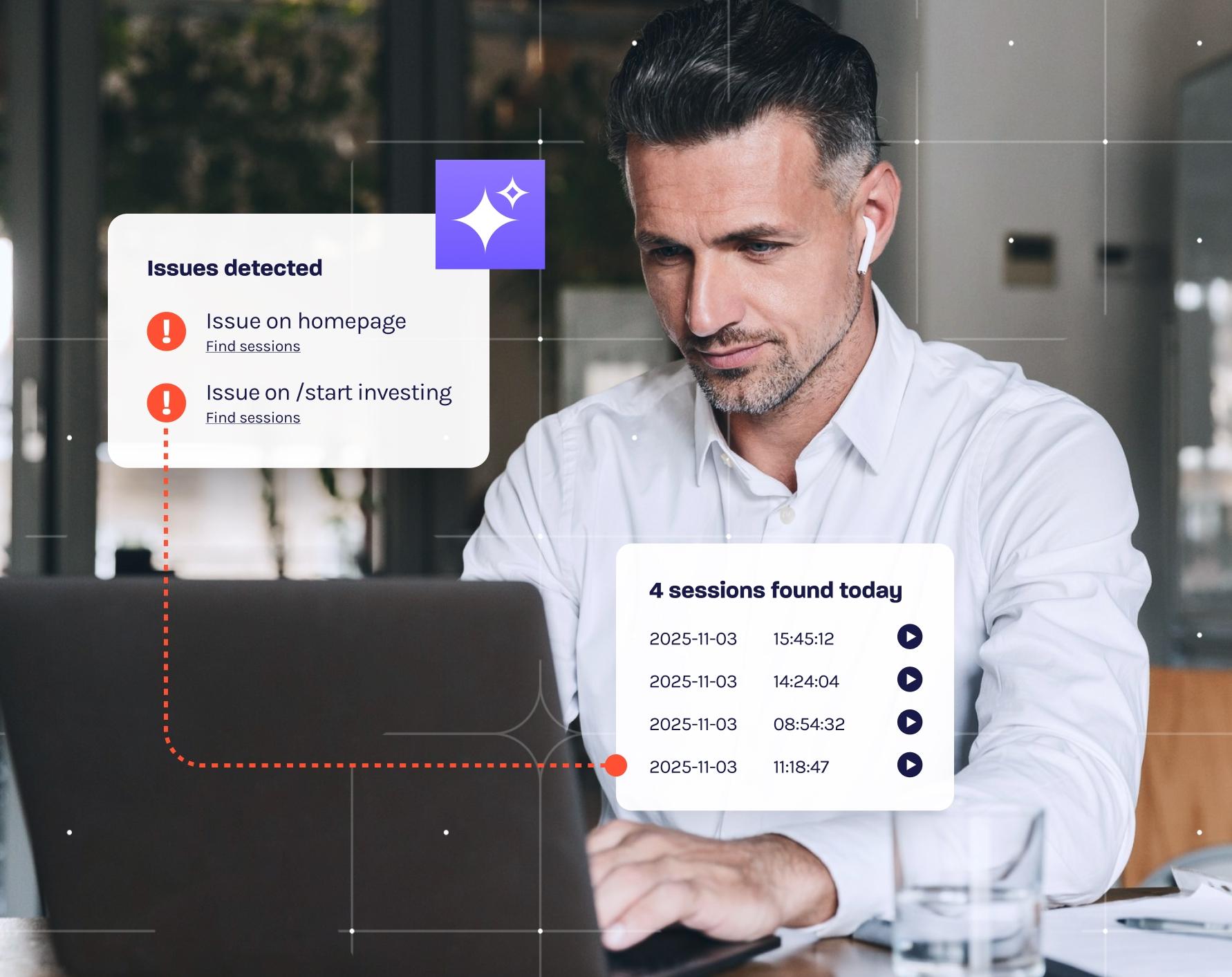

Glassbox helps teams build and maintain frictionless experiences by giving them full visibility into customer journeys and the behaviors that drive outcomes from digital banking and insurance workflows to patient-facing healthcare experiences. When you can see where users hesitate, loop or abandon, you can act with confidence and speed. Glassbox’s digital experience platform supports teams in identifying friction, prioritizing fixes and validating improvements with real-time data.

To see how teams confidently spot and remove friction, explore Glassbox’s struggle and error analysis solution, which helps teams identify friction points, understand why they occur and eliminate them with precision.